“Everybody dreads taxes”

Egbert Gaye

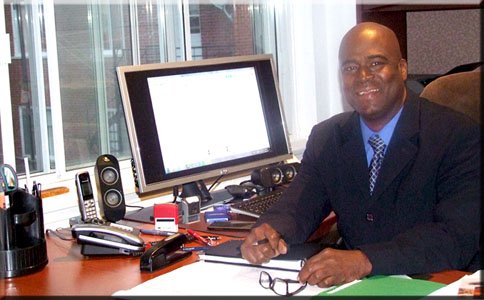

In the 11 years that Clarence Jones has been providing accounting services to clients at different levels of the socio-economic ladder, it’s easy to tell that he has been getting it right.

The smile, which is almost a permanent fixture on Jones’ face, is not because of the praise that is continuously heaped on him by satisfied clients, but mostly because of the satisfaction he gets from helping people, especially in his community, get their business in order.

“My biggest passion is to help my people, especially those who want to get to another level,” says Jones, a certified accountant, whose company CJAS is located in NDG. “Because I feel that we’re better than being just workers. We also have the ability to start and operate successful businesses.”

But he says too many in our community are venturing into business without first educating themselves on their rights and privileges and also on their obligations to the government when it comes to filing reports on time and paying their taxes.

“My advice is to sit with a professional and let him guide you through the process and the possible outcomes,” he says. “If not, there’s a higher likelihood of making bad decisions and having to resort to damage control.”

Jones says he has been told on many occasions by sources at the various government revenue agencies that Blacks are among the worse when it comes to taking care of their businesses.

And we’re just as bad as individuals filing personal income taxes.

“Too many people in our community are habitual late filers. I hear them saying things like: “I know that I have to pay anyways”, or “I hate the government.”

All of which, according to Jones, can be counter-productive, because by not filing on time, many are sitting on thousands of dollars owed to them by government for Solidarity Tax or GST refunds.

Knowing the many pitfalls that await entrepreneurs and individuals in meeting their obligations to the government, Jones uses his expertise to help one client at a time.

And in the decade or so that he has been doing it, many can attest to his usefulness.

“For the average business owner, Clarence is extremely useful,” says George Grant. “His knowledge of the taxation system and his ability to deal with agents at Revenue Quebec and Revenue Canada make him an invaluable asset.”

Grant, self-employed and a small business owner, has been using Jones to process payroll and taxes for several years and continues to be impressed by Jones’ efficiency.

“What impresses me most is how organized he is and how he’s able to remain calm even under the most stressful situations. He gets it done and he gets it done on time.”

And Pamela Dass, a self-employed real estate agent, is a new client.

“I’ve been with him for less than a year and I can sum up my experience in two words: action and results.

Although I’ve been using professional tax preparers for the past five years, my file has been a mess. Clarence took one look at it, did the necessary reassessment and was able to secure a significant reduction in what I was owning to the government.”

He’s extremely knowledgeable and competent. And because of him my financial outlook is very promising.”

Helen Baptiste, a health care worker, has been using Jones to help her file her personal income taxes for about six or seven years and testifies to his competence.

“He knows his work,”

However, his most admirable trait is not that he will never make a mistake, but the fact that he will take responsibility for that mistake and be prepared to compensate you for it.”

In true Trinidad and Tobago parlance, she says: “He is good people.”

Also, if there is one thing she takes him to task for is not finding ways to put vast knowledge of the tax system to the disposal of our community.

“I always suggest to him that he should be writing columns, holding seminars, and educating others.”

Jones says, for his part, the formula remains the same whether it’s business or personal when it comes to taxes.

“Always try to file on time. If you have issues, maintain contact with the government. And never leave those brown envelopes unopened.”

The big truth he says he has come to understand over the years is that “everybody dread taxes.”

To make the process easier he assumes full responsibility on behalf of most of his clients, asking them to sign an authorization form, which allows him to advocate or negotiate on their behalf.

But the big challenges remain in getting people to acquire the basic information before they are blind-sided by a major demand from the government that usually have them scurrying to the bank for a loan to make a payment.

“It’s important to be proactive rather than reactive.”

Jones, originally from St. Vincent and the Grenadines, was a schoolteacher and bookkeeper at home.

When he moved to Montreal, he initially contemplated going into Education, but ended up in the Accounting Program at Concordia University.

Over the years, he worked as a senior accountant at several firms before finally launching out on his own in 2004 when his last employer Robert Reeford Transport shut its doors.

At C.J.A.S he has been able to put together an extensive portfolio of clients from all ethno-cultural groups from across Quebec, Canada and the United States.

Many are from referrals, he says, and many drive in from out of town to sit with him to get their books in order.

Jones, who is capably supported in his office by his assistant, Victoria Durant, sees it as a privilege to be able to earn the confidence of his wide-ranging clientele.

As an accomplished musician and a lifelong member of Bibleway Pentecostal Church, Jones strives constantly towards enhancing the lives of others around him.

As far as George Grant is concerned, Jones easily achieves those aspirations and beyond.

“He is a prime example of the impact that a person can have when they are dedicated to their profession and their community. And Clarence does so with a smile.”

Reach C.J.A.S. at 4815 Bessborough Street, SUITE 4

Montreal, Qc. H4V 2S2 (T) 514-481-0842 (F) 514-481-0891.